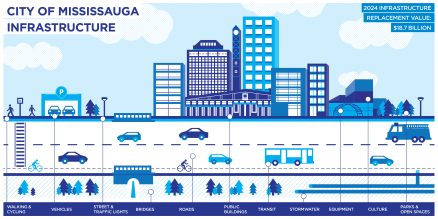

A portion of property taxes collected is used to maintain City roads, parks, traffic signals, buses, fire trucks and other critical infrastructure, but we are still facing a funding shortfall.

November 10, 2025

What to repair, what to replace

When you own an asset like a home or vehicle, you know that over time, repairs are required to help extend the asset’s life. However, more severe issues may require tougher decisions and a bigger budget, like replacing an entire roof or all four tires. City staff face similar challenges when it comes to managing infrastructure and its life cycle.

Through regular inspection, City staff make complex decisions about which assets to prioritize based on factors like wear and tear, usage and replacement costs. The City also looks at long-term cost savings such as whether to invest in electric and hydrogen buses that pollute less.

Being prepared and having a plan

The more information we have on City assets, the more effectively we can budget for repairs and replacement. Mississauga’s 2025 Corporate Asset Management Plan is a strategic document that outlines how the City will manage its municipal infrastructure, including core and non-core assets. For example, trees are assessed every seven years, roads every four years, structural bridges and culverts every two years, playgrounds monthly and sidewalks are inspected annually for deficiencies.

Taxpayers help fund important repairs

A critical tool that is available to the City is the Capital Infrastructure & Debt Repayment Levy. It is part of the City’s total budget and is reflected in the property tax bills. Money collected through this levy is used to maintain and replace infrastructure. For example, in 2025, the City invested $325.1 million in many upgrades. This includes trail reconstruction at Birchwood, Bough Beeches and multiple parks across the city; sports amenities rehabilitation at Courtneypark Athletic Fields, Erin Meadows and more, and playground rehabilitation at Huron Park, McKechnie Woods and others.

In 2025, the City also began constructing new infrastructure such as Fire Station 123 located at Winston Churchill Blvd. and The Collegeway, designed as a net zero energy building. Other examples include the Huron Heights stormwater facility project to reduce the risk of flooding and improve water quality in the downstream Cooksville Creek watershed.

Developers and higher levels of government help fund new infrastructure

While property taxes help with repairs and replacement, this covers only a part of the overall need. When a developer is building new homes, offices or factories, they are required to pay Development Charges (DCs) to the City, which are kept in reserve funds for future use. The City uses these reserve funds to build or upgrade roads, sidewalks, bus shelters, traffic signals, community centres, libraries, parks and other such infrastructure. This helps create a complete community, where the new home occupants are provided with easy access to their neighbourhood and the wider city.

With inflation and rising costs of construction, the City does not have sufficient funding to meet all our infrastructure needs. This is why the City advocates to the other levels of government with deeper pockets for grants and other sources of funding. In 2025, federal grant funding helped with bus stop replacements, bridge and structural renewal, and sidewalk repairs at various locations throughout the city.

Shortfall in infrastructure funding

Although municipalities own 60 per cent of Canada’s public infrastructure, they receive only 10 cents of every tax dollar collected in total by all three levels of government to fund and maintain it. Unlike provincial and federal governments, municipalities lack diverse funding options such as payroll, sales taxes and additional revenue streams. The City’s funding options consist only of property taxes, limited fees and charges, or issuing debt.

With limited options available, the City faces an infrastructure gap of approximately $90 million annually over the next 10 years. An infrastructure gap is a funding shortfall or the difference between the budget needed to keep infrastructure in a state of good repair and the actual budget that is available. To avoid unfairly burdening taxpayers, the City is dedicated to finding savings and efficiencies, as well as highlighting the necessity for sustainable funding from regional, provincial, and federal governments. Every level of government has a role to play in building our city.

Get infrastructure-savvy

On January 6, 2026, the City’s proposed 2026 Budget will be available for public review. In the meantime, give yourself a budget refresher through these useful resources available on the budget webpage mississauga.ca/budget:

- What infrastructure is important for the City to maintain

- 2025 Corporate Asset Management Plan

- City’s federal advocacy requests

- Understanding your 2025 taxes

- How the City budget works

- How the City gets money

- How the City spends money

Stay tuned for the next Budget Committee meeting coming up on January 12, 2026.

Have ideas about the budget and want to share them with the City? Reach out to your Councillor or email budget@mississauga.ca to highlight what you see as priorities.